Teen Financial Literacy:Full Financial Fallout?

JOSEPH NEY-JUN

ANGELA YANG

Staff Writers

In the United States, April is also known as ‘Financial Literacy Month,’ a time for Americans to educate themselves or brush up on their financial literacy. April has long since passed, but high school students and other young adults are often reminded that they need to manage their money well to save up for their futures.

Many high school graduates have to take out loans and apply for financial aid to be able to pay tens of thousands of dollars for their higher education. Statistics published by the College Board in 2013 found that the average tuition fee for a public four-year college was roughly $21,706, while private four-year colleges cost $29,056.

Not all high school graduates will be managing their finances for their higher education however. According to the U.S. Bureau of Labor Statistics, only 66.2% of high school graduates attend college. Becoming 18 places new financial responsibilities upon graduates who move out on their own. They now must manage their taxes, income, budget for bills and necessary expenses. Mismanagement of their finances can incur legal repercussions for mistakes such as using the wrong paperwork or even slight miscalculations.

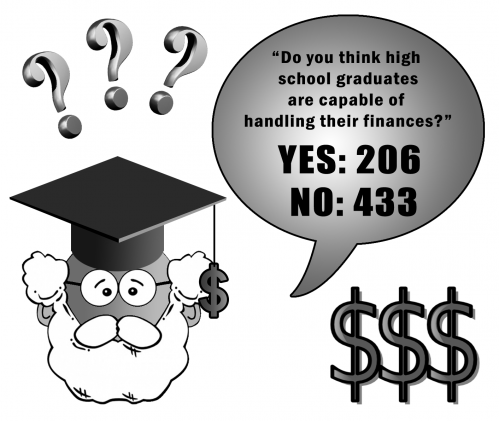

In this time of economic uncertainty, it has been a growing concern that many high school graduates lack the basic skills and knowledge to manage their finances. A 2011 survey of high school seniors sponsored by Capital One, a U.S. based bank holding company, found that only 38 percent of the seniors felt comfortable about managing their finances independently.

“When people go to college, [they] tend to overspend and think their parents are going to [manage their finances] for them,” sophomore Raymond Huynh said.

In the same survey on college seniors by Capital One, it was found that 87 percent of students get information about financial management from their parents, but only 19 percent have created a budget plan for their future in college.

Ultimately, many believe that financial education should be a requirement to graduate high school.

“I don’t think high school graduates are able to handle their own finances because even though they are done with their high school education, it does not mean that they were taught money management, [which] usually helps in the future with personal finances,” sophomore Nikki Tran said.