For-Profit Colleges For Massive Student Loans

DEREK WU

ANGELA YANG

Staff Writers

It’s that time of the year again: seniors are now into their last year of high school and determining what to do with the rest of their lives.

A good majority, 66.2 percent in 2012 according to the U.S. Department of Labor, usually choose to continue with higher education. Some may choose private or public universities; however some may opt for a for-profit college. For those who may not know of for-profit colleges, or proprietary schools, they are essentially schools whose primary focus is making money.

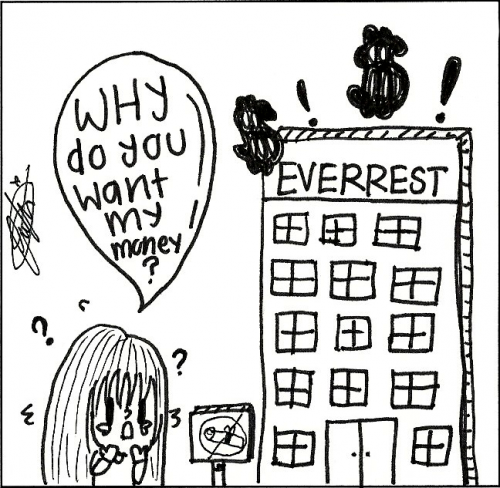

For-profit schools play a large role in the student loan crisis. The difference between for-profit colleges and universities such as USC and Harvard is that the latter aren’t run like businesses; for-profit colleges are sponsored by the owners of the colleges and focus more on pleasing their shareholders rather than providing an education for their students. For these sponsors and business owners, making more money is their number one priority.

For-profit schools have recently been placed under suspicion for deceitful recruiting tactics, promising prospective students a “good career” and later having them take out thousands of dollars in loans when they enroll.

However, the government wanted to pass a “Gainful Employment Act” which would regulate the for-profit college system.

The bill would make sure a number of students would receive work after they would graduate. If they did not find a career, there financial aid would be taken away which would force these colleges to lose money.

However due to heavy funding to Congress from college owners like John Sperling, a weaker, less regulated version was passed. An example would be Full-Sail University, which is sponsored by Mitt Romney and his fund-raising chair; one can see promotions for for-profit universities in his interviews.

A four year bachelor’s degree is around $63,000, while a community college would cost around $53,000. From 2005 to 2012, the number of students taking out loans increased 66 percent, from 23.3 million to 38.8 million.

However only 12 percent of Americans attend and enroll in these colleges, yet approximately 50 percent of the American college loan crisis comes from these students borrowers.

With the demanding schedules of many of these colleges, it’s hard to balance school, a job, and a social life, causing a lower rate of graduating within four years. In fact, the four year graduation rate of a program such as the video game art program at Full-Sail University, which costs $81,000, is 14 percent out of the 44 precent that graduate.

The degree students can earn from for-profit colleges are not reputable and creates difficulties for these students to find jobs and establish careers after graduating. Credits students earn from these colleges will also be harder to retain and transfer to other colleges.

Harkin’s study also revealed that tuition for B.A. programs at for-profit colleges are around 19 percent higher than those of public universities.

This incredibly high tuition causes many students to take out loans their degrees will probably not help them pay off in the future, especially given that finding a job becomes even harder with a degree from a for-profit school.

Ultimately, we can establish that for-profit colleges act only in the interests of their shareholders, rather than for the best education they can give their students.

A college or university should do as much as possible to help their students become ultimately successful in life without a monetary-based agenda. The misleading nature of for-profit colleges should not be trusted nor further supported.