Capital Appreciation Bonds, Debt for Future Generation

DENISE TIEU

Staff Writer

Over the past six years, more than 400 school districts in California have generated a larger amount in Capital Appreciation Bond (CAB) debt than in any other state.

According to California State Treasurer Bill Lockyer, these districts have borrowed $9 billion for new buildings, maintenance and educational materials, which will cost taxpayers up to $36 billion in the next 40 years.

CABs are loans issued by the state and local governments to school districts and small businesses; they are similar to loans in that they must be repaid with compound interest. However, unlike traditional loans, the principal amount must be repaid on the bond’s maturity date, 40 years later. While school districts do not have to make regular payments on the principal amount, they have to make monthly payments on the interest the CABs generate.

No two CAB payments work the same way, since they depend on many factors such as the investors whom the districts receive the bonds from, the economy and the credit rating.

“California doesn’t give enough money to districts. [Therefore], districts come up with money through bonds,” Assistant Superintendent of Financial Services Denise Jaramillo said.

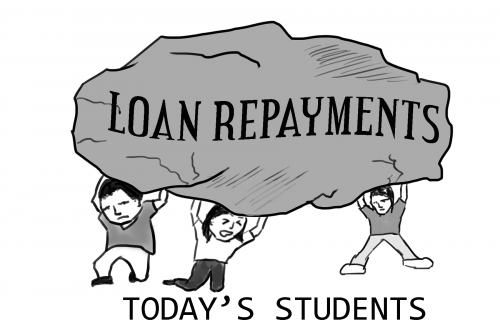

By the time the payments are due, the people who have requested these bonds will be long retired or have moved away, leaving the debt to whoever remains in the area, namely, the current students, whom the district is borrowing the money for.

In AUSD’s case, Alhambra homeowners are required to pay off the interest that is generated by CABs.

“The latest bond [AUSD has been issued will have to be paid] every year [for] over 30 years. [The money] is collected in property taxes and the county takes it and uses it to pay off the bonds,” Jaramillo said.

The Poway Unified School District, considered the “poster child” of CAB issues, has borrowed a little over $105 million, but the total debt will exceed $1 billion by the time that all the repayments are made.

Several years ago, bankers at George K. Baum & Company issued bonds to Placentia-Yorba Linda Unified, believing that the residents’ taxes would not rise. However, the bankers failed to account for real estate appreciation, which calculates the taxes that homeowners will have to pay to support the bonds. As a solution to the increase in taxes, bankers started to design CABs.

Though districts have used CABs for over a decade, there was a slight increase in usage in 2009 when California passed AB 1388, which removed its flat debt service requirement, meaning that annual payments for bonds will not remain the same each year.

An investigation completed by the California Watch found that California has some of the most lenient rules involving CABs in the nation. The decision to issue CABs rather than traditional bonds is typically made after voters have approved of the bond measures. According to the New York Times, many voters, and even several school board members, did not realize that supporting the bond measures would lead to huge debts that local residents would have to pay off in 40 years.

“I feel that issuing bonds is a great idea. In 40 years, as a taxpayer, I do not mind helping pay back these bonds,” senior Ronnie Chan said.

According to the Southern California Public Radio, AUSD had taken out a $21 million long-term bond in 2009, which will be repaid in 33 years. In the end, the district will end up with a debt of almost $130 million. Since 2004, voters in Alhambra have approved these CAB measures on the local ballot.

“The district would have to use money [that is] used to educate the students [in order] to pay back loans without [CABs]. So, instead, communities vote and pass bonds to have better facilities,” Jaramillo said.

Lockyer and Tom Torlakson, the State Superintendent of Instruction, wrote a letter to school districts in mid-January, urging them to stop using CABs. The governor and state legislature have also proposed ways to restrict CABs usage.

“I feel annoyed that I’m obligated to be one of those taxpayers, but that’s one of the duties we have as citizen[s],” senior Kathy Thach said.