Governor Brown Introduces Tax Initiative to Offset Educational Budget Cuts

SHANNON LI

Staff Writer

The state of California has the highest population in the United States. Four years ago, it ranked as the 43rd state out of 50 in terms of per-pupil spending in education. This year, California slipped into 47th place; when adjusted for regional differences, the state spends $8,667 per student, which is about $3,000 below the national average of $11,665, according to the Quality Counts report from Education Week.

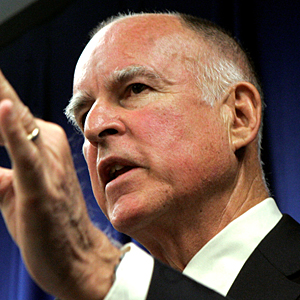

Governor Jerry Brown introduced a ballot to increase taxes on sales and wealthy earners, “designed to balance the state budget, prevent further cuts to education, provide a progressive tax structure and provide constitutional protections of public safety realignment funding,” according to his website.

The original plan would raise taxes on those who make more than $250,000 and raise sales tax by 0.5 percent until 2017, which was projected to raise $5 billion for K-12 education and community colleges, according to the California Department of Finance.

Brown combined his initiative with another similar education measure, the Millionaires Tax Initiative, in order to increase its chances of passing the November 2012 ballot. The combination also changed the duration of the tax increases from five to seven years. It also raised the tax rate for high earners and lowered the sales tax increase from 0.5 percent to 0.25 percent. If passed, the initiative is estimated to raise about $7 billion annually. The California State Universities (CSU) and Universities of California (UC) would also gain a four percent increase in state funding starting in 2013.

According to the daily newspaper The Sacramento Bee, the initiative also frees up general funds that can be used for other state programs, such as corrections, universities or social services.

Numerous teachers, public safety officials, businesses and community leaders across the state are declaring their support for the act.

“When you issue thousands of layoff notices for educators, you are hurting students,” California Teachers’ Association President Dean Vogel said in San Mateo’s The Daily Journal. “When you continually lay off teachers, you break the bonds of learning, and you send the message that education is not a priority in our state.”

Many children and parents rallied throughout the state in to protest against the state’s continual lack of funding for public schools and garner support for the bill.

“This bill should be passed because it helps sustain our core and extracurricular programs,” senior Alex Perez said. “We won’t have to worry about more and more budget cuts like we have had [to] for years.”

The act will not only offset the budgetary problems for Californian elementary and high schools, but CSUs and UCs as well. However, it is not without its flaws.

“I’m generally in favor of the measure, but its language is a bit vague because it does not guarantee a set proportion of the budget will go specifically to K-12 education,” Paul Stein said. “The language doesn’t guarantee that money originally meant for education won’t be diverted elsewhere. However, we don’t have much of a choice; any law that gives money to the schools is better than none.”